des moines new mexico sales tax rate

The Des Moines New Mexico sales tax is 513 the same as the New Mexico state sales tax. This includes the sales tax rates on the state county city and special levels.

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Des Moines which passed a penny sales tax in 2018 lowered its property tax rate by 60 cents in 2019.

. Tax rates are provided by Avalara and updated monthly. For tax rates in other cities see Iowa sales taxes by city and county. This year the city plans to maintain its rate at 1661.

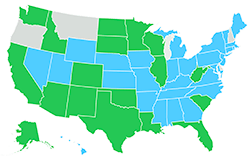

New Mexico City and Locality Sales Taxes. Click on any city name for the applicable local sales tax rates. Highest and Lowest Sales Taxes Among Major Cities.

The Des Moines County Iowa sales tax is 700 consisting of 600 Iowa state sales tax and 100 Des Moines County local sales taxesThe local sales tax consists of a 100 county sales tax. Des Moines is located within Union County New Mexico. Cities at 10 percent.

This is the total of state county and city sales tax rates. They are followed by Chicago Illinois. And Seattle Washington each with rates of 95 percent.

Depending on local municipalities the total tax rate can be as high as 90625. This rate includes any state county city and local sales taxes. While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected.

Birmingham and Montgomery both in Alabama have the highest combined state and local sales tax rate among major US. The County sales tax rate is 0. Some cities and local governments in Des Moines County collect additional local sales taxes which can be as high as 88817841970013E-16.

The total sales tax rate in any given location can be broken down into state county city and special district rates. 2020 rates included for use while preparing your income tax deduction. The Des Moines Sales Tax is collected by the merchant on all qualifying.

While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. This table shows the total sales tax rates for all cities and towns in. A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 6 Iowa sales tax.

The New Mexico NM state sales tax rate is currently 5125. New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125. Des Moines in Washington has a tax rate of 10 for 2021 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Des Moines totaling 35.

The 7 sales tax rate in Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax. 600 Is this data incorrect The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. The average cumulative sales tax rate in Des Moines New Mexico is 606.

The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. The West Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. Within Des Moines there is 1 zip code with the most populous zip code being 88418.

Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. Puerto Rico has a 105 sales tax and Des Moines County collects an additional 1 so the minimum sales tax rate in Des Moines County is 7 not including any city or special district taxes. Look up 2021 sales tax rates for Des Montes New Mexico and surrounding areas.

The minimum combined 2022 sales tax rate for Des Moines Washington is 101. Portland Oregon and Anchorage Alaska. The Des Moines sales tax rate is 36.

Groceries are exempt from the Des Moines and Washington state sales taxes. And Des Moines Iowa also 1 percent. You can print a 7 sales tax table here.

Generally a business will pass that tax on to the consumer so that it resembles a sales tax. Very Important Map Shows Where Majority Of America S Pizza Is Located Map United States Map American History Timeline. 3 rows 61875 lower than the maximum sales tax.

The minimum combined 2022 sales tax rate for Des Moines New Mexico is. This is the total of state county and city sales tax rates. Look up 2021 sales tax rates for South Des Moines Iowa and surrounding areas.

The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. The 7 sales tax rate in West Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax. There is no applicable city tax or special tax.

Tax rates are provided by Avalara and updated monthly. This is the total of state county and city sales tax rates. The Des Moines County Sales Tax is 1.

Browse New Mexico CPA Firms for sale on BizQuest. The Washington sales tax rate is currently 65. New Mexico has a gross receipts tax that is imposed on persons engaged in business in New Mexico.

The sales tax rate does not vary based on zip code. The cost of living in Des Moines is 21 lower than the national average. The Des Moines Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Des Moines local sales taxesThe local sales tax consists of a 350 city sales tax.

The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. An alternative sales tax rate of 775 applies in the tax region Des Moines which appertains to zip code 88418. Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent.

What is the sales tax rate in Des Moines New Mexico. Groceries are exempt from the Des Moines County and Iowa state. The cost of living in Des Moines is 13 lower than the New Mexico average.

The West Des Moines Sales Tax is collected by the merchant on all qualifying sales made within West Des. The sales taxes in Hawaii and New Mexico have broad bases that include. Remember that zip code boundaries dont always match up with political boundaries like Des Moines or Union County so you shouldnt always rely on something as imprecise as.

The Des Moines County Sales Tax is collected by the merchant on all qualifying sales made within Des Moines County. Des Moines Sales Tax. Cities or towns marked with an have a local city-level sales tax potentially in addition to additional local government sales taxes.

The latest sales tax rate for Des Moines NM.

Gross Receipts Location Code And Tax Rate Map Governments

Illinois Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Iowa Sales Tax Rates By City County 2022

New Mexico Sales Tax Calculator Reverse Sales Dremployee

Louisiana Sales Tax Rates By City County 2022

Gross Receipts Location Code And Tax Rate Map Governments

Washington Sales Tax Rates By City County 2022

Washington Property Tax Calculator Smartasset

Gross Receipts Location Code And Tax Rate Map Governments

Sales Tax Rates In Major Cities Tax Data Tax Foundation

New Mexico Sales Tax Rates By City County 2022

Missouri Sales Tax Rates By City County 2022

Gross Receipts Location Code And Tax Rate Map Governments

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Iowa Tax Reform Details Analysis Tax Foundation

This Is The Most Expensive State In America According To Data Best Life